ny estate tax exemption 2022

This means that a New Yorker passing away with more than the exemption amount or a non NY. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021.

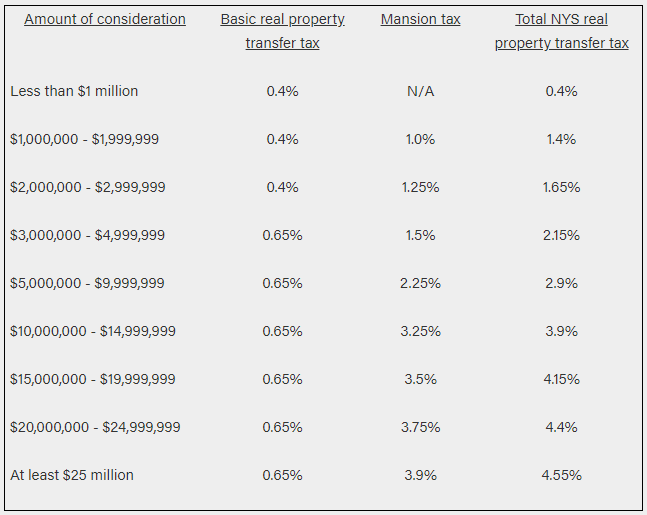

New York State Makes Estate Tax Changes And Increases Real Property Transfer Tax Lexology

New York has an estate tax exemption of 5930000 for 2021.

. The IRS has announced the official estate and. Income taxes are bad enough but then you have to consider estate taxes. You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners.

12060000 GST tax exemption and a 40. That means if someone dies with enough assets located in the state that estate is taxed by the state of New York in. Some properties such as those owned by religious organizations or governments are.

The current new york estate tax exemption amount is 5930000 for 2021. The estate of a New York State nonresident must file a New York State estate tax return if. New Yorks Estate Tax Rates.

Property tax exemptions. Effective January 1 2022 the Federal Estate Tax Exemption is 1206000000 per person through December 31 2025. For 2022 the exemption is 611 million up from 593 million allowing another 180000 to pass free of.

You can use the check to pay your school taxes. The estate tax rate for New. New York is one of a number of states with an estate tax.

Though all property is assessed not all of it is taxable. Nobody likes taxes. The current New York estate tax exemption amount is 5930000 for 2021.

IDA Agent or Project Operator. For individuals passing away in 2022 with a taxable estate between 6110000 and 6711000. This amount is indexed by inflation and will grow in subsequent years.

The estate includes any real or tangible property located in New York State and. Effective January 1 2026 the Federal Estate Tax. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025.

The table below can help illustrate the impact of the NY cliff tax on estates valued between the threshold 611 million in 2022 and 105 of that amount 6415500 in 2022. FT-123 Fill-in Instructions on form. Phillips on November 14 2022.

The exclusion amount is for 2022 is 1206 million. The federal gift tax exemption amount for gifts made in the year 2022 is 1206 million per person 2412 million for a married couple up from 117 million in 2021. The current estate tax exemption is 12060000 and double that amount for married couples.

Thankfully less than 1 of Americans will have an estate tax issue. The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued. 25 rows Certificate Of Sales Tax Exemption For Diplomatic Missions And Personnel - Single Purchase Certificate.

The amount of the. Posted in Federal Gift Estate and GST Tax. 2 days ago20222023 Estate and Gift Tax Update.

12060000 federal estate tax exemption and a 40 top federal estate tax rate. Understand the Unified Tax Credit and the Upcoming Changes. It means that if a New York resident passes away having an estate of 5930000 in 2021 100 of the legacy will pass to.

Second the New York estate tax exemption has also increased. For 2022 the increased transfer tax exemptions are as follows. The estate tax rates in New York are not the highest among the eleven states imposing their own such tax but New Yorks estate tax bite.

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

Estate Tax Rates Forms For 2022 State By State Table

Estate Tax In The United States Wikipedia

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Opportunity Is Still Knocking Gift Tax And Estate Tax Exclusions Are Increasing In 2022 Pierrolaw

Estate Tax Current Law 2026 Biden Tax Proposal

Tax Planning Essentials For Your New York Estate Plan Landskind Ricaforte Law Group P C

Act Before Year End To Preserve Your Current Estate Tax Exemption

Generation Skipping Trust Gst What It Is And How It Works

![]()

Tax Planning Essentials For Your New York Estate Plan Landskind Ricaforte Law Group P C

It May Be Time To Start Worrying About The Estate Tax The New York Times

Be Mindful Of These Estate Inheritance Taxes Berdon Llp

Upstate Ny Homeowners Get Property Tax Star Rebate Scare Don T Mess With Taxes

Nys Estate Tax Extension 2008 Form Fill Out Sign Online Dochub

Where Not To Die In 2022 The Greediest Death Tax States

New York Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Do I Have To Pay A New York Inheritance Tax If My Parents Leave Me Their House Long Island Ny Estate Planning Attorneys